Attorneys To Work For You

Our Free 15-minute Consultation

After the IRS audited our client and found taxes due of $120,915 over a three-year period, plus the FTB audit identified an amount due of $39,935, we requested and obtained a re-audit. All the taxes due were reduced to zero.

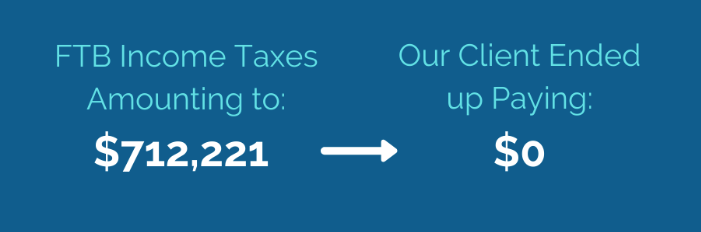

Our tax lawyers successfully defended clients against FTB income tax assessment of $712,221, with the liability reduced to zero; They also prevented the clients’ names from appearing on FTB published list of largest tax liabilities in California.

Our tax lawyers obtained abatements and refunds of IRS and FTB penalties for failure to timely file tax returns, failure to timely pay tax, and failure to make estimated tax payments for clients based upon physical and emotional illnesses, a death in the family and the burden of caring for autistic child; total of $365,243 in penalties and interest refunded to clients.

Our client, an estate, was charged late filing and late payment penalties of over $320,000 based upon a failure to timely pay and file the Estate tax return. After the Estate paid the amounts claimed to be due we were able to obtain a full refund of the amount paid plus interest.

After an audit, the California Franchise Tax Board (FTB) billed our client for over $ 2 million. Our client paid the tax and filed a claim for refund which was denied by the FTB. After we filed a petition with the California State Board of Equalization (SBE), we negotiated a settlement with the FTB which resulted in our client receiving a refund of all the money he paid, plus interest.

A restaurant was facing a three-year sales tax audit by the California State Board of Equalization (BOE) (now called the CDTFA). This new restaurant business had used an improperly installed and calibrated point of sale ("POS") system and had incorrectly prepared its sales tax returns for the audit period in question.

The Solution:Our tax lawyers successfully defended the restaurant against the BOE, limiting the total adjustment amount agreed upon for that period to $64,000.

Further, we were able to convince the SBE to refrain from imposing any negligence penalty on the taxpayer and to afford the taxpayer a 24-month installment agreement to fully pay the liability off over time.

Our clients were the owners of a closely held family company. After an audit the IRS claimed that the compensation paid to them was unreasonable, and therefore disallowed $750,000 per year in deductions over a multi-year period.

The case was referred to our firm by a tax attorney who had spent over two years negotiating with the IRS, without achieving a settlement.

The Solution:Our firm negotiated a settlement with the IRS that saved our clients $2.1 million in tax, penalty, and interest.

Our client, a U.S. citizen living and working overseas had failed to file his 2014 federal income tax return despite earning nearly $500,000 in his profession that year.

The IRS subsequently prepared a "substitute for return" for his 2014 tax year, which included all his income (based on the IRS' records) for that year, but which allowed him no exemptions, deductions, or tax credits to which he was properly entitled.

The IRS then issued a Notice of Deficiency to him demanding payment of about $275,000 in tax, failure to file and failure to pay penalties, and interest for that year.

The Solution:After filing in the United States Tax Court, our tax lawyers were able to demonstrate that the client was entitled to various exemptions, deductions, and foreign tax credits.

The IRS eventually conceded as a "no change" decision, meaning the client was required to pay nothing additional in tax, penalty, or interest for that year.

The Internal Revenue Service (IRS) assessed late filing and late payment penalties pursuant to Internal Revenue Code § 6651, plus interest, of almost $500,000 against our client for a three-year period. We filed a petition with the United States Tax Court, and convinced the IRS attorneys to wipe out all the penalties and associated interest.

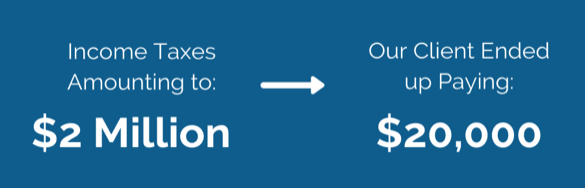

The IRS claimed our client owed almost $2 million dollars in income taxes due to alleged errors on his tax returns. After filing a petition with the United States Tax Court, we settled the case for approximately $20,000.

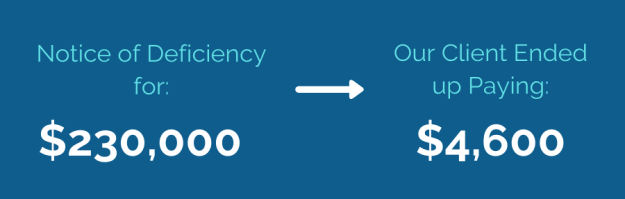

Our client received a statutory notice of deficiency from the IRS after an audit claiming that over $230,000 was owed. After filing a petition with the United States Tax Court, a settlement was negotiated for less than $4,600.

Our client a high-powered litigation attorney, fell behind on his federal income taxes, and with interest and penalties owed almost $800,000 to the IRS.

The Solution:Our tax attorneys were able to settle the matter with the IRS with an offer in compromise for less than $150,000. It took almost four years, and our tax attorneys had to file in the U.S. Tax Court to obtain this resolution. Our client’s CPA said we were “miracle workers.”

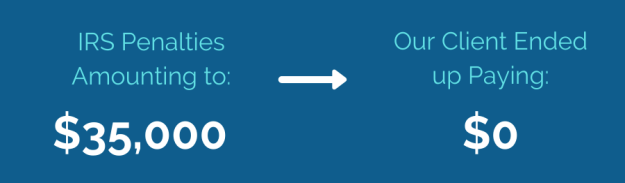

The IRS claimed our clients owed over $35,000 as the result of an audit. Due to technical errors made by the IRS we were able to convince the IRS to abate the full amount of the taxes and to refund amounts previously paid.

The Internal Revenue Service (IRS) had served a tax levy on our client’s social security checks for Federal income taxes covering 8 years of over $75,000. Our tax problem lawyers convinced the IRS that our client couldn’t afford to make even minimal payments, and the IRS released its tax levy, and agreed to stop all collection efforts.

Our lawyers successfully handled an IRS corporate income tax audit of a software technology company. The amount of taxes due was only $1,702, and we were able to limit the audit period to one year only.

Our tax litigation lawyers negotiated a 40 percent settlement reduction of taxes due based upon the hazards of litigation faced by the IRS. We reduced the assessed income tax liabilities for three years from the $682,882 asserted by IRS to $405,495. Then we successfully negotiated with the IRS for an offer in compromise that reduced our client’s liability further to $156,809.

A clothing manufacturer located in the Los Angeles garment district received IRS notification that it was selected for auditing relating to Form 8300.

The Form 8300 is used to report receipt of cash payments greater than $10,000.

However, our taxpayer was in a new "Geographic Targeting Zone" which instead required that cash payments of more than $3,000 be reported on Form 8300.

The Solution:Our client claimed that they had never received the Geographic Targeting Order requiring the filing of Form 8300 for the lower amount, although the issue had been widely reported in the popular press because of concerns by FinCEN that the Los Angeles garment district was a hotbed of money-laundering.

Our tax attorneys successfully defended the client, and the tax audit was closed as a "no change" audit with no tax or penalties owed or imposed.

These statements do not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.