Attorneys To Work For You

Our Free 15-minute Consultation

Our client was facing over 7 million dollars in FBAR penalties from the IRS. There was also a significant underpayment of tax which had not been reported on the tax returns.

The IRS threatened of penalties, and additional taxes more than 36 million dollars if our clients “opted out” of the IRS' Offshore Voluntary Disclosure Program (OVDP).

The Solution:Our tax litigation lawyers advised our clients to "opt out" of the IRS' Offshore Voluntary Disclosure Program (OVDP).

Although it took several years of hard fighting, we successfully negotiated a settlement with the IRS under which our clients paid only $50,000 in non-willful FBAR penalties.

Part of the reason that we were able to negotiate such a successful settlement was that our clients were willing to "hang in there" despite IRS threats.

When the IRS demanded a miscellaneous penalty of $341,702 under the 2009 Offshore Voluntary Disclosure Program (“OVDP”), our attorneys successfully obtained “no willful” treatment. Our client’s IRS penalty was reduced to $40,000.

The FTB challenged our client's "private annuity contract" ("PAC") offshore tax advantaged retirement plan for the years 2006 through 2008.

The PAC was challenged on various grounds in its Notices of Proposed Assessment and later Notices of Action, including the lack of economic substance. The FTB also imposed a so-called "NEST" penalty.

The Solution:Our tax attorneys were successful over a period of about ten years in defending our client's PAC. We represented the client through the FTB audit level, the FTB appeal level, and then through filing of an appeal of the FTB's Notices of Action with the California Office of Tax Appeals ("OTA").

During this time, the federal statute of limitations on tax assessments for those years expired before the FTB could transmit any final result in the case to the IRS. This resulted in the client paying nothing additional in federal income tax for those years.

Our attorneys were then able to settle the OTA case involving the state tax liabilities, with the FTB conceding 25% of the asserted state tax liability despite its characterization of the plan as a "tax shelter,” and its original position that the NEST penalty should be applied.

The settlement terms also included:

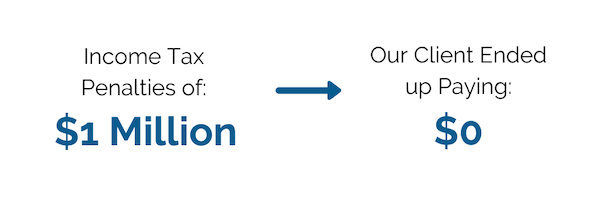

While she was married our client incurred joint income tax liabilities more than $1,000,000. We were able to convince the Internal Revenue Service that our client was an innocent spouse pursuant to Internal Revenue Code § 6015, and the IRS wiped out her entire tax bill.

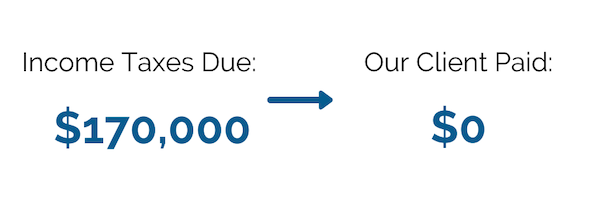

Our client owed over $170,000 in federal income taxes, and the IRS had already served a levy on her bank account. We convinced the IRS that she was an innocent spouse, and all the money was released. In a separate proceeding we obtained innocent spouse treatment from the California Franchise Tax Board (FTB).

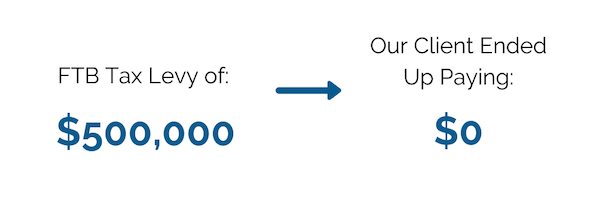

The FTB had levied our client to collect joint tax liabilities more than $500,000. We were able to get the levy released and ultimately received innocent spouse status for our client.

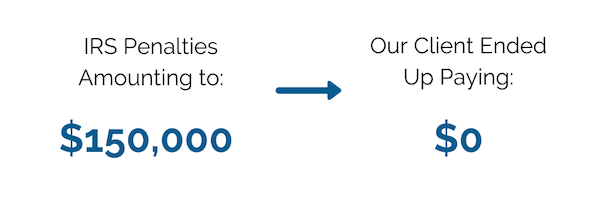

Our client filed a joint return with her spouse, a successful lawyer earning over $500,000 per year. Although he promised her, he would pay the $150,000 tax due, he never did.

After they were divorced he refused to pay, and when she applied to receive innocent spouse treatment he fought “tooth and nail” to make sure she remained liable for the taxes.

The Solution:Nevertheless, our tax lawyers prevailed, and the Internal Revenue Service granted innocent spouse status. Our client walked away paying nothing to the IRS.

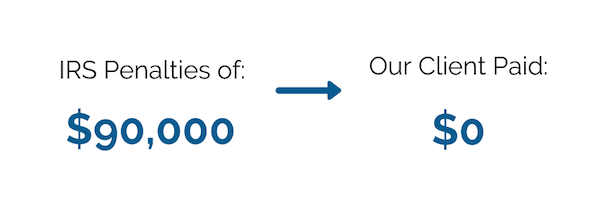

Prior to retaining our firm, the client’s previous tax attorney had filed a request with the IRS for innocent spouse relief. The IRS only granted innocent spouse status for 2 of the 7 years requested and was still attempting to collect approximately $90,000 from our client. After this firm filed an appeal, the IRS granted our client innocent spouse status for the remaining 5 years.

These statements do not constitute a guarantee, warranty, or prediction regarding the outcome of your legal matter.